How do you calculate property taxes?

A property tax is a tax on owned property, collected from the property's owner by a taxing authority or government. Historically, property taxes were often collected on an individual's entire net worth. In modern times, however, the most common form of property tax is a tax on real property. Real property refers to land and fixed improvements, such as buildings.

The most common method of calculating property tax depends on two important measurements. The property's assessed value is the base taxable value of the property to be taxed, and the property tax rate or millage rate is the actual tax rate levied on the assessed value of the property.

How Assessed Value is Calculated

Assessed value is the taxable value of a property, as determined by the tax assessor responsible for collecting taxes on that property. Property taxes are generally an ad valorem tax, which means that properties are taxed "according to value". Thus, the assessed value of a property is often related on the fair market value of that property - that is, the price at which an informed buyer would purchase the property from an informed seller, with neither being under any pressure to sell.

The assessed value of a property, however, is not always the same as the fair market value. Many taxing jurisdictions only tax a certain percentage of the fair market value of a property. This taxable portion of the fair market value is known as the assessment ratio.

For example, if a county has an assessment ration of 30%, and the fair market value of a property is deemed to be $100,000, the assessed taxable value of that property would be $30,000.

Homestead exemptions are also factored into the assessed taxable value of a property. In many jurisdictions, if a piece of property is inhabited by the owner as a permanent residence, a certain percentage (or flat amount) of the property's value is exempt from taxation. If your jurisdiction has a homestead exemption, it can be subtracted from the assessed value before calculating property tax owed.

Property Tax Rates & Millage

Once the taxable value of a property has been determined by the tax assessor, they calculate the amount of tax due. While every locality has alightly different methods of determining the amount of tax due, the majority of property taxes are collected based on a measurement known as millage.

Millage infers the amount of tax collected per thousand units of property worth. For example, a millage rate of 10 means that for every $1,000 of assessed value the property will be subject to $10 of property tax. This converts to approximately 1% of the property's assessed value.

The Property Tax Equation

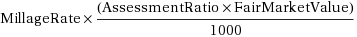

The general equation that can be used to calculate property tax is as follows:

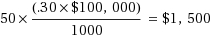

We can test this forumula by calculating the property tax on the example property we discussed above. Let's assume property's fair market value is $100,000, and the county has an assessment ratio of 30% and a millage rate of 50.

In this situation, the property tax due on the property is $1,500, or the equivalent of 1.5% of the property's fair market value.

To calculate the property tax on a specific property, you must know at least the three variables used in the above equation. For estimation purposes, you can use our property tax records tool or our property tax estimator to look up your most recent property tax appraisal and an estimate of your property tax.

Our property tax estimates are based on average property taxes as percentage of home value. As you can see from the previous example, average percentage of home value is closely related to actual property tax amounts - but, as calculation methods vary county to county, percentage estimates may be different from the property tax your assessor computes.

Learn more in the Property Tax FAQ